The public knows relatively little about Christopher C. Davis, although his money and projects will affect Garrison and Cold Spring for a very long time to come. Since he moved to Garrison in the 1990s, Davis, a self-described “city kid,” has become increasingly active in environmental causes, mainly through Scenic Hudson and the Hudson Highlands Land Trust. In 1999, he purchased the Garrison Golf Course to protect it from real estate development, and now he has offered 98 of its acres for the Hudson Valley Shakespeare Festival.

The proposed Fjord Trail, however, is Davis’ most ambitious and controversial project. Davis and the Fjord Trail are inextricably linked. Indeed, without Davis, the Fjord Trail as currently envisioned would not exist.[1] He is its leading private financial backer, and is Chair of the non-profit Hudson Highlands Fjord Trail, Inc. (HHFT), the Scenic Hudson offshoot that is leading the project. Yet Davis has stayed out of the public eye. He was not among the 19 individuals (state and local public officials, and two representatives from HHFT) who met several hundred citizens on May 8 at Haldane High School – where the Fjord Trail plans were roundly condemned, especially by Cold Spring residents. Davis, age 58, rarely gives local press interviews. The project has been planned behind closed doors, and the public won’t get to vote on it.

The Fjord Trail, if built, would transform Cold Spring and a beautiful 7.5-mile riverfront stretch of the Hudson Highlands. Cold Spring, a village with fewer than 2,000 residents, would be swamped by an HHFT-estimated 600,000 visitors per year. The project’s finances – both the capital costs (estimated at $82 million, and counting), and ongoing maintenance – are murky and sketchy. HHFT is counting on a Davis family private foundation, and public money.[2] Will there be enough money to finish and maintain this project, or will Cold Spring be stuck with the bill – and possibly stuck with a pedestrian bridge, and a concrete walkway in the river, to nowhere?

No one doubts that Chris Davis has good intentions, but he hasn’t been elected and isn’t accountable to the voters. His outsized, unfettered, role raises the question, who is Chris Davis, and should we trust his judgment? We’ve looked at Chris Davis’ track record in business, which is how he is best known beyond the Hudson Valley, and the source of his wealth. We were surprised to find a dismal record the past 15 years or so.

Clients Withdrew $77.6 Billion – or 83% of Assets

Chris Davis was born into a family that for two generations had been making money – a lot of it – by investing in stocks on Wall Street. In 1997, he formally took over the Davis mutual fund business, although father Shelby M. C. Davis stayed close at hand, as chief investment officer.[3] For the first ten years, the business thrived. In June 2007, the Davis funds were managing client assets worth $93.6 billion – an all-time high for the firm.

Since June 2007, however, there have been massive client redemptions. The total value of client assets managed by the Davis funds has plunged 83%, to $15.9 billion – a mind-boggling outflow of $77.6 billion.[4]

At $15.9 billion, Chris Davis now is managing at least $4 billion less money than when he took over the business 26 years ago.[5]

It’s a disappointing performance for someone who is quoted as an expert in the national financial press, and who sits on two prestigious corporate boards, Berkshire Hathaway Inc. and The Coca-Cola Company.

To be clear, the investors didn’t lose $77.6 billion – they withdrew $77.6 billion (probably more, since the funds made money during that period).[6] We cannot be sure why investors withdrew their money, but fund underperformance, and big, well-publicized, mistakes, probably contributed to a general loss of confidence.

The $77.6 billion withdrawal is documented in quarterly reports that Davis is required to file publicly with the Securities and Exchange Commission. You can see those reports yourself – we’ve attached them as exhibits.

We sent Davis a note summarizing our findings, including the investment mistakes described below. He declined to comment, saying he likes to leave his business in the city and not bring it to the Hudson Valley.

The Mistakes “Keep Piling Up,” Morningstar Says

The Davis funds have poor ratings from Morningstar, Inc., the independent investment research firm that covers 1,150 mutual funds.

Today, the biggest and most important Davis fund – the flagship Davis New York Venture Fund – has one of the worst possible Morningstar ratings. It gets one star, on a scale of one to five stars. That puts the fund in the bottom 10% of all mutual funds in its category.[7]

Morningstar said it has “waning confidence” in flagship fund co-managers Chris Davis and Danton G. Goei, in a report on the fund dated 10/25/23.

“These managers’ mistakes keep piling up,” Morningstar said. “A prolonged period of mediocre stock selection and, at times, questionable execution does not inspire confidence.” Morningstar criticized the managers’ “middling stock selection,” “poorly timed sector moves,” and “underwhelming results.” The Morningstar report is attached as Annex A.

In 2022, Morningstar issued a similar report, calling Davis’ investment approach “aggressive,” “risky,” and “quirky,” with “wild performance swings.”

If you had invested in the Davis funds 15 years ago, you would have done poorly compared with other mutual funds in the “large blend” category, the latest Morningstar report says. Over that 15-year period, the flagship Davis fund ranked at the bottom – the 94th percentile.

Investors chase performance, and over the longer term, including since Chris Davis took over in 1997, the Davis performance has lagged its benchmark, the S&P 500 Index. For the past 10 years, the flagship Davis fund reported an average annual total return of 9.4%, while the index returned 12.7%. The underperformance was worse for the past five years, when the fund’s average annual total return was 6.9%, and the index returned 12.2%. The 10-year and five-year results would have been even worse but for the fund’s one-year good performance during the fiscal year that ended this July 31.[8]

The AIG and Sino-Forest Blowups

No doubt, investors have been scared away by staggering wipeouts in individual stocks.

The insurance company American International Group (AIG) was a frightening example. Historically, insurance stocks were the Davis family specialty, beginning with Chris’ grandfather, Shelby Cullom Davis, an unrivaled expert.[9]

Go back to June 2007, just before AIG collapsed. On 6/30/07, the Davis funds held AIG shares worth $4.1 billion (or $70.03 per share). Over the next twelve months, as AIG stock lost 62% of its value, Davis stubbornly bought more, bulking up from 59.7 million shares to 73.9 million shares. Finally, Davis reversed course and started selling, but it was too late. Davis investors were completely exposed to the AIG meltdown. On 12/31/08, the Davis funds owned almost exactly the same number of AIG shares as they owned a year and a half earlier. The Davis AIG shares, however, now were worth only $94 million (or $1.57 per share).[10] That’s a loss of 98%. Looks like about $4 billion in investors’ money was flushed down the drain. See Exhibit A (below) for the details.

AIG was a big mistake. But not the last big mistake. What was Chris Davis thinking, when the funds bought stock representing 13% ownership of Chinese timber company Sino-Forest Corporation? Nobody had ever heard of Sino-Forest Corporation. That is, not until 2011, when it was exposed as a fraud. A year later, it went bankrupt. The Davis funds lost over $600 million in that wipeout.[11]

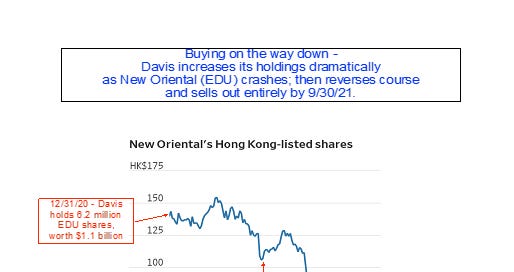

Buying New Oriental, As It Was Crashing

You might expect that, after the Sino-Forest blowup, Chris Davis would have been very careful about further investments in China. Instead, the flagship fund made “bold forays into markets such as China,” Morningstar said. A good example, with a disastrous outcome, is New Oriental Education & Technology Group, the biggest private tutoring company in China.[12]

By year-end 2020, the Davis funds had accumulated a $1.1-billion position in New Oriental, worth $185.81 per share. Then the stock began crashing. Davis reverted to the same gambit that backfired so badly with AIG – as the stock dropped, Davis bought more. Over the next six months, Davis increased the position from 6.2 million shares to 106.3 million shares. But those shares now were worth only $8.19 each – a decline of 95%. Abruptly, Davis threw in the towel, and over the next three months sold out entirely. Bought high, sold low.

What was going on at New Oriental? Obviously, the Davis funds hadn’t a clue. But other market players seemed to know, and bailed out before a big Chinese government announcement on July 24, 2021. A new government policy restricted New Oriental and other tutoring companies from profit-making activities. “Overnight, the tutoring industry faced an existential crisis,” The New Yorker reported.[13] The Davis funds were roadkill.

The Davis Funds, Today and Tomorrow

You could say that Chris Davis is a contrarian – or maybe he’s just idiosyncratic. Today, he’s going against the crowd once again, by doubling down on bank stocks. The flagship fund plows 50% of its assets into the Financials sector – four times more than the benchmark’s 12% weighting. And Davis weights Information Technology at only 12% – less than half the benchmark, which is at 27%.[14] The concentration in Financials, plus a relatively heavy weighting in foreign stocks (typically 15% to 30% of assets), are reasons why Morningstar calls the fund “aggressive” and “risky.”

The Davis funds are value-oriented funds, and it’s sometimes said that value funds have become unpopular in recent years, compared to growth funds. There are winners and losers among the value funds, however, as judged by assets under management. We’ve prepared a scorecard, at Exhibit E (below). The Davis funds are among the biggest losers.

Twenty years ago, a glowing history of the Davis family business was published – The Davis Dynasty: Fifty Years of Successful Investing on Wall Street.[15] A blurb was contributed by Maurice R. “Hank” Greenberg, then chairman and CEO of AIG (needless to say, a few years before AIG crumbled). Greenberg said he had “many years’ experience with the Davis dynasty,” and praised the family’s “remarkable success and endurance.” So far, it's been three generations – but how long will it endure? No member of the next Davis generation holds a leadership job at the firm.

❖ ❖ ❖

Life was so much better in June 2007, when the Davis funds were sitting on $93.6 billion in client assets, and hauling in big fees. And it was during those palmy days that Chris Davis’ grandmother, the widow of Shelby Cullom Davis, made a most generous gift. On June 15, 2007, Kathryn W. Davis, aged 100, gave an interview[16] to The New York Times to announce that she was donating $20 million to Scenic Hudson.

“One thing I want to do is save the Hudson River, see it accessible and swimmable and green along the banks,” Mrs. Davis said. “They say money is the root of all evil, but it can be the root of good things, too, and I hope that’s what mine will do,” she said. “I’m a little surprised to be giving away $20 million, but I trust Scenic Hudson will be careful and won’t throw it around, won’t let it fall into wrack and ruin.”

Are her hopes being realized – specifically, by the Fjord Trail that her grandson, and Scenic Hudson, are insisting upon? It is Chris who introduced his grandmother to Scenic Hudson. And now Chris and Scenic Hudson, in tandem, are trying to push through the Fjord Trail. They claim that their plans are consistent with her hopes for the river. (Memo to Chris and Scenic Hudson: she said “green along the banks.” She didn’t say “cut down hundreds of trees, and pour thousands of tons of concrete, along the banks.”)

When Kathryn Davis announced her gift in June 2007, she had plenty of reason to be optimistic. Ever since then, however, the Davis funds, with Chris Davis at the helm, have had a rough, disappointing, ride.[17]

Would you entrust the future of your community to Chris Davis?

December 8, 2023

❖ ❖ ❖

Shelby Cullom Davis and his wife, Kathryn W. Davis. He was U.S. Ambassador to Switzerland during the Nixon and Ford administrations.

Their son, Shelby M. C. Davis.

Their grandson, Christopher C. Davis.

Footnotes

[1] The Fjord Trail project stalled in 2017 for lack of funds, until Chris Davis stepped in. He thought the existing plans were “soulless,” so he (or the Davis foundation; see footnote 2) paid for the 2020 master plan, which reflects his ideas and those of a 16-year-old New York City landscape design firm he helped bring in, called SCAPE. See Chronogram article (10/27/23) at https://www.chronogram.com/river-newsroom/the-battle-over-the-hudson-highlands-fjord-trail-19300194?media=AMP+HTML.

[2] For the Fjord Trail to get built, much will depend on Chris Davis’ ability to get Fjord Trail grants approved by the charitable foundation started by his grandfather, called the Shelby Cullom Davis Charitable Fund Inc. The foundation had $2.98 billion in assets at year-end 2022 (the most recent year for which a tax filing, called a Form 990-PF, is available). At that time, the foundation was overseen by eight directors, all apparently Davis family members including Chris (who was Secretary of the board), and an executive director. Local citizens tend to assume that Chris Davis personally is helping finance the Fjord Trail – that all the Davis money is coming out of his own pocket. In fact, however, the foundation is the far more important donor. In the past 11 years of available foundation tax filings (2012 through 2022), the foundation gave grants totaling: (i) for the Fjord Trail explicitly (through grants to Scenic Hudson, Hudson Highlands Fjord Trail (HHFT), and the Hudson Highlands Land Trust), $59,625,000, (ii) for Scenic Hudson, not explicitly for the Fjord Trail, $28,025,000, (iii) for the Hudson Highlands Land Trust, not explicitly for the Fjord Trail, $775,000, and (iv) for Riverkeeper, $550,000. These grants total $88,975,000. How much did Chris Davis personally contribute in addition to this $88.9 million? Scenic Hudson’s recent annual reports are opaque. For each of the past seven years (2017 to 2023), Scenic Hudson has listed gifts of more than $500,000 from “Shelby Cullom Davis Charitable Fund / Christopher C. Davis.” By lumping together the foundation, and Chris Davis, as donors, Scenic Hudson has made it impossible to know who gave what. We do know, however, from the foundation’s tax filings that, in each of the seven years from 2016 to 2022, the foundation gave at least $500,000 to Scenic Hudson. It’s possible, therefore, that the foundation, and not Chris Davis personally, was responsible for the entirety of the Davis gifts to Scenic Hudson in those years. On the other hand, Chris had a prior history of making personal gifts to Scenic Hudson. In Scenic Hudson’s annual reports for 2014 through 2016, Chris Davis personally is listed as giving Scenic Hudson between $100,000 and $500,000. In two of those years, the foundation also gave gifts within the same dollar range. All this is relevant to the question of – where will future necessary private financing for the Fjord Trail come from? Is Scenic Hudson-HHFT counting on the Davis foundation, or Chris Davis personally, or both? And if something were to happen to Chris Davis meanwhile – would the foundation continue to support the Fjord Trail – the capital costs, and ongoing maintenance – and, if so, to what extent? If there are binding written pledges, the public hasn’t seen them. The Fjord Trail’s proponents (HHFT) make empty assertions lacking any supporting evidence. For example, an October 2023 advertisement from HHFT blandly says, “the majority of the Fjord Trail capital project will be financed by private donations and grants.” No details were given. The ad also said that “HHFT’s operating budget will be primarily funded by private donations, grants, and earned revenue from parking fees and programming at the Visitor Center.” Whether these donations and grants are already in hand, or pledged, or are mere hopes, is left to our imagination. In answer to the question, “how will the Fjord Trail project be funded?”, the HHFT website says that “the Fjord Trail capital project is being primarily funded through the generosity of a private family foundation with additional support from other private donors and grants from New York State.” In February 2022, Scenic Hudson estimated the project would cost $86 million. Scenic Hudson said the NYC Department of Environmental Protection had pledged $14 million for construction of the vehicular access bridge, leaving New York State and Scenic Hudson-HHFT to cover the remaining $72 million. In April 2022, a $20 million line item for the Fjord Trail was included in the New York State budget capital plan. See the Scenic Hudson statement here, https://www.nysenate.gov/sites/default/files/scenic_hudson_1.pdf, and see an article about the $20 million here: https://www.poughkeepsiejournal.com/story/news/2022/04/22/hudson-highlands-fjord-trail-moves-forward-20-m-funding/7409532001/. See the Davis foundation’s 2022 Form 990-PF at: https://projects.propublica.org/nonprofits/organizations/203734688/202302769349101100/full.

[3] When Chris Davis assumed responsibility in 1997, his father, then 59 years old, stepped to the sidelines as a “coach” (as he put it), or chief investment officer. See John Rothchild, The Davis Dynasty: Fifty Years of Successful Investing on Wall Street, at 268 (2003) (hereafter “Davis Dynasty”). We don’t know when Chris’ father stopped being the chief investment officer.

[4] The period reviewed is from 6/30/07 to 9/30/23, or 16 years and three months. The information is taken from quarterly reports on Form 13F filed publicly with the SEC by Davis Selected Advisers, L.P., the investment management firm for all the Davis mutual funds. See Exhibit A (below) for a summary of Form 13F information filed by Davis, and see Exhibits B-1 and B-2 for relevant pages from Davis’ Form 13Fs for 6/30/07 and 9/30/23. Davis, and other investment management firms, must file Form 13F reports of stocks held on behalf of clients. (See footnote 6 for information about other Davis client assets that are not reported on Form 13F.) There are about a dozen Davis mutual funds, with the flagship Davis New York Venture Fund by far the largest and most important (Selected American Shares is the second-biggest). The Form 13F reports for Davis Selected Advisers consolidate the holdings for all the Davis mutual funds. In 1995, Chris Davis became a portfolio manager (with his father Shelby M. C. Davis) of the flagship funds (Davis New York Venture Fund and Selected American Shares). In 1997, Chris took over from his father as Chairman of Davis Selected Advisers. For Davis, having clients withdraw $77.6 billion means losing out on hundreds of millions of dollars in annual fees. For example, the Davis New York Venture Fund charges holders of its largest class of shares (Class A) annual fees and expenses totaling 0.92% of account values. See the Davis New York Venture Fund Annual Report for the fiscal year ended 7/31/23 (the “Davis Venture 2023 Annual Report”), at https://davisfunds.com/documents/DNYVFAnn.pdf, at 4.

[5] The $4 billion figure is an approximation based on the most recent Davis Form 13F (for 9/30/23), which shows $15.9 billion in total assets, and the Davis Form 13F for 3/31/99, which shows $20.4 billion in total assets – a difference of $4.5 billion. The 3/31/99 filing is the first Form 13F that Davis filed electronically on the SEC’s EDGAR online system; before that, it filed paper copies that cannot be accessed on EDGAR. As discussed in footnote 6, Davis manages other assets that are not reported on Form 13F, which probably explains why Davis today says the firm hold more than $20 billion in client assets. It’s possible that Davis today is managing as much as $9 billion less than he did in 1997. According to a history of the Davis family, in 1997 Davis managed $25 billion. See Davis Dynasty, supra note 3, at 269. The book doesn’t specify the source for that $25 billion figure – whether from Form 13F, or from a total that includes all client assets, including non-Form 13F assets. For relevant pages from the Davis Form 13F filed on 3/31/99, see Exhibit C (below).

[6] The amount of client assets withdrawn may be closer to $80 billion than $77.6 billion. According to the 2023 Morningstar report (see Annex A), Davis’ “assets under management dropped to USD 20 billion from USD 100 billion in the mid-2000s.” SEC rules require that certain client assets be excluded from Form 13F, such as cash, bonds, and stocks that aren’t traded on US stock exchanges (including private equity). Davis manages some of these other, non-Form 13F, assets on behalf of clients. In the 2023 proxy statement for Graham Holdings Company, where Chris Davis is a director, the Davis firm is described as overseeing more than $20 billion in assets as of 12/31/22 – on which date, however, the Davis Form 13F reported $14.7 billion in assets. The difference, $5.3 billion, is not explained. In each of the four preceding Graham Holdings proxy statements, there were similar discrepancies, ranging from $5.1 billion to $5.5 billion, between the amount of assets described in the proxy versus the (lower) amount reported on the corresponding Davis Form 13F. See the Graham Holdings 2023 proxy statement: https://www.ghco.com/static-files/24cbb448-8d6f-4d67-b34e-3fd44e14ace0. In this report, we’ve compared apples to apples: the Davis Form 13F assets as of 6/30/07 ($93.6 billion) with its Form 13F assets as of 9/30/23 ($15.9 billion), a difference of $77.6 billion, or 83%. The Davis firm acts as investment adviser not only for registered investment companies (such as the Davis mutual funds), but also for unregistered investment companies, offshore funds, private accounts, and other pooled investment vehicles.

[7] Morningstar gives the Davis flagship fund one star, plus “Neutral.” The absolute worst rating is one star, plus “Negative.” In its report, Morningstar also downgraded the Davis team’s experience and ability ranking to “Average,” making clear that the problem is ability, not experience. Morningstar’s ratings measure a fund’s risk-adjusted return, relative to similar funds. Davis apparently believes in the Morningstar rating system. In a filing with the SEC, Davis says that the Davis New York Venture Fund from time to time “may publish the ranking and/or star rating of the performance of its classes of shares by Morningstar, Inc.” See the fund’s Statement of Additional Information, at 43, here: https://davisfunds.com/documents/DNYVFSAI.pdf.

[8] See the Davis Venture 2023 Annual Report, supra note 4, at 4. For Davis’ fiscal year that ended this July 31, the fund was up 23% and the index was up 13%. All performance periods cited ended on 7/31/23. The 10-year and five-year underperformance by Davis therefore includes the results of the one-year outperformance. Davis doesn’t disclose its performance over a 15-year period. In addition, the Morningstar report (see Annex A) says that, since Chris Davis took over as lead manager in early 1997, the Davis New York Venture Fund’s Class A shares had an annualized gain of 7.5%, which trailed the benchmark S&P 500 Index’s 8.4% return, but beat the typical peer’s 7 %.

[9] Chris Davis’ grandfather, Shelby Cullom Davis, was an extraordinarily successful investor. His remarkable career is described in Davis Dynasty, supra note 3. In 1947, Shelby Cullom Davis quit his political-appointee job as First Deputy Superintendent of Insurance for New York State and became a full-time investor, specializing in insurance company stocks. Often using borrowed money (margin loans) to buy stocks, he turned an initial $50,000 into $900 million upon his death in 1994. His fortune came from wise investing for his own account. Unlike his son and grandson, he did not run a mutual fund (nor depend on client fees). He did not believe in leaving great wealth to his children. His son Shelby M. C. Davis, among his other children, got nothing directly from him (Davis Dynasty, at 262). Instead, Grandfather Davis’ fortune went to the Shelby Cullom Davis Charitable Fund Inc., which in turn invested it in Shelby M. C. Davis’ mutual funds. According to its 2022 financial report (supra note 2), the foundation had total assets worth $2.983 billion, of which $2.928 billion was invested in corporate stocks. Today, the Davis funds say that the Davis family and foundation, and fund employees and directors, have more than $2 billion invested alongside clients, in similarly managed accounts and strategies. Shelby M. C. Davis, who had a sometimes distant relationship with his father, took over the tiny New York Venture Fund in 1969 (with two friends he later bought out). Shelby M. C. Davis compiled an excellent investing record with the fund (renamed the Davis New York Venture Fund), handily beating the S&P 500 index. Chris’ ambition has been to beat the S&P 500 index “over time” (Davis Dynasty, at 272).

[10] See Exhibit A (below) for a summary of Davis’s AIG holdings over time. For a history of AIG’s collapse, see articles by Gretchen Morgenson in The New York Times, on 9/27/08 at: https://www.nytimes.com/2008/09/28/business/28melt.html?_r=2&hp=...ef=slogin&adxnnlx=1222574344-sryB0EIlGw9r0bMocyaxOQ&oref=slogin and on 3/7/09 at: https://www.nytimes.com/2009/03/08/business/08gret.html.

[11] Sino-Forest, with operations in China, filed for bankruptcy in March 2012, and its stock was delisted from the Toronto Stock Exchange two months later. Sino-Forest didn’t own the forests it promised to cut down. The Sino-Forest fraud burned other investors besides Davis, including hedge fund titan John Paulson. See Bloomberg News article in the Financial Post (6/22/11), at: https://financialpost.com/investing/paulson-wasnt-the-only-one-to-lose-a-bundle-on-sino-forest.

[12] In January 2014, soon after the Sino-Forest bankruptcy, Davis replaced his co-manager of the fund, Kenneth Feinberg, with Danton Goei. In 2016, Goei also became sole manager of the Davis Global and Davis International funds. “Many of Goei’s high-conviction bets since then have hindered performance, including positions in numerous Chinese stocks,” Morningstar said of the Global Fund. “For example, his allocations to New Oriental Education & Technology Group and Alibaba peaked at around 10% of assets each before their share prices plummeted more than 90% and 70%, respectively. Goei’s patient approach backfired, as he began selling both stocks after each had already fallen substantially.” See Morningstar reports on the Davis Global Fund and the Davis International Fund, both dated 10/16/23. The Global fund has a two-star and Neutral rating; the International fund has a one-star and Neutral rating.

[13] See 5/16/22 article at https://www.newyorker.com/culture/culture-desk/the-larger-meaning-of-chinas-crackdown-on-school-tutoring. Did Chris read page 97 of Davis Dynasty? Which says that his grandfather Shelby Cullom Davis, while not rattled by stock market gyrations, “still kept an eye on the tape. A ‘prolonged sinking spell’ in a specific company was, to him, a sign of possible trouble behind the scenes. Most likely, a swoon occurred when knowledgeable insiders dumped their shares.”

[14] The Davis Venture 2023 Annual Report, supra note 4, at 3. “We believe the select companies we own have durable competitive advantages and bright prospects,” Davis says in the recent Semi-Annual Review 2023 for the Davis New York Venture Fund, at: https://davisfunds.com/funds/nyventure-fund/pm-review.

[15] Davis Dynasty, supra note 3.

[16] See https://www.nytimes.com/2007/06/15/nyregion/15lives.html?smid=nytcore-ios-share&referringSource=articleShare. Kathryn W. Davis died in 2013.

[17] Chris Davis has expressed ambivalence, at best, about his occupation. In his youth, Chris considered becoming a priest. After he fortuitously avoided the 9/11 disaster, he questioned his life’s work. It “resonated” with him when famed investor Charles Munger told him that money management is a “low calling.” See CNN Money article at https://money.cnn.com/2001/10/22/funds/q_tendays_main/index.htm).

Scenic Hudson & Kickback Cathy Hochul wake up and heed the voice of the people?

How much money does the voice of the people represent? That is all these oligarchs/plutocrats care about.

The only way to stop this environmental and cultural destruction is by a coordinated legal strategy (including an antitrust attack) which will require a large amount of funding, but more difficult to find in NYS, it will require an honest, non activist, apolitical judicial system, and in DC a DOJ devoted less to partisanship than to the well being and legality of the Republic.

The whole HHFT disgrace is typical of our nation's progression towards an oligarchy, and the only way to combat this is with a very vigorous return to Constitutional legality, and a non-partisan implementation of antitrust actions against institutions (including higher education), corporations, and individuals, in an effort to return political power back to the people.

In our nation oligarchy=plutocracy and the only way to destroy one is to bankrupt the other.

thanks for this. davis is who i assumed he is: rich boy playing w/money his folks and grandfolks earned in order to burnish a fragile ego. this is a common phenomenon. if his vanity project takes place, it will be the death of Cold Spring and much of the Hudson Valley. Scenic Hudson, the relevant NYS agencies and assorted politicians up to and including the governor need to wake up and heed the voice of the people.